Jack Lawrence Accountants and Advisors

Superannuation Updates

From 1st July 2022, if you are 67 to 74 year old and wish to make voluntary contributions to your superannuation, you must meet the work test requirement. For all other contributions, the requirement for a work test has been scrapped in the latest Treasury bill passed earlier this year (Treasury Laws Amendment (Enhancing Superannuation Outcomes for Australians and Helping Australian Businesses Invest Bill 2021). The work test requirement is proof that an individual has been gainfully employed for 30 days before any contribution is made to a superannuation fund. Gainfully employed suggests that the individual was paid for working 40 hours over a consecutive 30 day period during a financial year, before making the voluntary super contribution.

Superannuation Guarantee Rate Increases

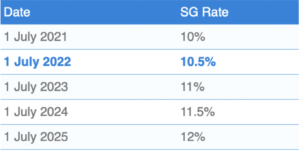

On 1 July 2022, the SG rate is legislated to increase from 10% to 10.5%. It is then scheduled to increase 0.5% every year until it reaches 12%.

The $450 per month eligibility threshold for when SG is paid is being removed. Meaning that employees can be eligible for SG, regardless of how much they earn. You may have to pay SG for the first time for some or all of your employees.

Directors ID

Intending new directors must apply before being appointed. Directors appointed on or before 31 October 2021 have until 30 November 2022 to apply. New directors appointed for the first time between 1 November 2021 and 4 April 2022 had 28 days from their appointment to apply. While those appointed on or before 31 October 2021 have until 30 November 2022 to apply, all directors are strongly encouraged to apply now through the MyGovID app.

Setting up MyGovID

Use two of the following Australian identity documents that verify their identity to set up their myGovID: passport (not more than three years expired) and Medicare card.

Applying at ABRS Online

Directors will log on to ABRS online using their myGovID, and will need additional information the ATO knows about them, including: Tax file number (TFN) Residential address as held by the ATO Information from two documents to verify identity. Most successful applicants use two of the following: bank account details (to which the individual’s tax refunds or payments are made and received) an ATO notice of assessment.

From July 1st a rebate of $1000 is available to small business owners to purchase items that improve work health and safety, You must attend an eligible SafeWork NSW event before you apply. Eligibility includes Small business owners and sole traders who have an ABN and less than 50 full time employee Charities and not for profits

NSW Storms and Floods Disaster Grant for Small Businesses

The February and March 2022 storm and flood disaster recovery has been extended to the Waverley Local Government Area. You may be eligible for $50,000 if your business was directly affected by the NSW storms and floods. Eligible expenses include: clean up leasing temporary premises replacing lost or damaged stock tradespeople hiring equipment safety inspections Apply through the NSW Government website, or see below for link

|